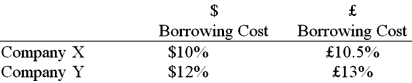

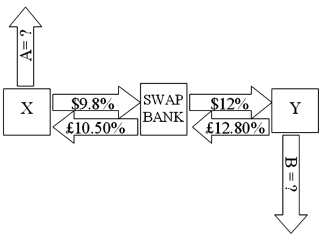

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years. The exchange rate is $2 = £1 and is not expected to change over the next 5 years. Their external borrowing opportunities are:  A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%. Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.

A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80%; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5%. Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12%.  If company X takes on the swap, what external actions should they engage in?

If company X takes on the swap, what external actions should they engage in?

Definitions:

Nation of Immigrants

Refers to the concept that a country is largely made up of immigrants and their descendants, emphasizing the diversity and multicultural aspects of its population.

Productivity Growth

An increase in the efficiency of production, often measured by the amount of goods and services produced per unit of labor.

Labor Force

All the members of a particular organization or population who are able to work, viewed collectively.

Productivity Per Worker

A measure of output produced per unit of labor, often used to gauge the efficiency and performance of an economy's workforce.

Q2: Compute the domestic country beta of Stansfield

Q12: Assume that you have invested $100,000 in

Q39: American Depository Receipt (ADRs) represent foreign stocks<br>A)denominated

Q39: Which of the following statements is true

Q54: North Korea, Iran, and Cuba are examples

Q61: Global bond issues<br>A)can save U.S. issuers 20

Q74: Calculate the euro-based return an Italian investor

Q93: Comparing agency versus dealer markets, which combination

Q96: The stock market of country A has

Q99: Companies domiciled in countries with weak investor