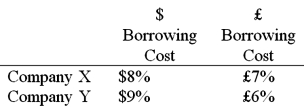

Company X wants to borrow $10,000,000 floating for 1 year; company Y wants to borrow £5,000,000 fixed for 1 year. The spot exchange rate is $2 = £1 and IRP calculates the one-year forward rate as $2.00 × (1.08) /£1.00 × (1.06) = $2.0377/£1. Their external borrowing opportunities are:  A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

Definitions:

Psychoticism

A personality pattern typified by aggressiveness and interpersonal hostility, often linked to higher risk of developing psychotic disorders.

Surface Traits

Observable qualities or characteristics of personality that can easily be inferred from outward behavior, as opposed to deeper, more latent traits.

Gordon Allport

A pioneering psychologist known for his theory of personality that emphasized individuality and the concept of the self.

Recommendation

A suggestion or proposal as to the best course of action, particularly one put forward by someone who is authoritative or knowledgeable.

Q22: The advantages of a market order include

Q26: Find the weighted average cost of capital

Q31: FASB 52 requires<br>A)the current rate method of

Q36: The variance of the exchange rate is:<br>A)0.0200<br>B)0.10<br>C)0.002<br>D)none

Q39: A domestic bank that follows a multinational

Q50: Teltrex International can borrow $3,000,000 at LIBOR

Q63: Your banker quotes the euro-zone risk-free rate

Q68: Bonds with equity warrants<br>A)are really the same

Q76: For the U.S. affiliate shown below, net

Q93: Comparing agency versus dealer markets, which combination