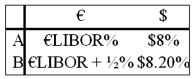

Come up with a swap (principal + interest) for two parties A and B who have the following borrowing opportunities.  The current exchange rate is $1.60 = €1.00. Company "A" wishes to borrow $1,000,000 for 5 years and "B" wants to borrow €625,000 for 5 years. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B. Firms A and B are more concerned with what currency that they borrow in than whether the debt is fixed or floating.

The current exchange rate is $1.60 = €1.00. Company "A" wishes to borrow $1,000,000 for 5 years and "B" wants to borrow €625,000 for 5 years. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B. Firms A and B are more concerned with what currency that they borrow in than whether the debt is fixed or floating.

Definitions:

Lottery Winnings

Income received from winning lotteries, which is often subject to taxation.

Semiannual Payments

Payments made twice a year as part of a financial agreement, often seen in the context of bonds or loans.

Interest Rate

The percentage of the principal amount charged by a lender to a borrower for the use of assets, usually expressed as an annual rate.

Down Payment

An initial, upfront payment made for the purchase of an asset, with the balance of the price to be paid later.

Q4: Eurocredits feature rollover pricing.<br>A)Rollover pricing was created

Q26: A "Eurobond" issue is<br>A)one denominated in a

Q34: Which of the following statements is true

Q44: What is the levered after-tax incremental cash

Q76: Consider a bond with an equity warrant.

Q83: Find the NPV in euro for the

Q89: Using the flow to equity methodology, what

Q89: Also, MNCs often find it profitable to

Q93: The coupon interest on Eurobonds<br>A)is paid annually.<br>B)is

Q98: Solnik (1984) examined the effect of exchange