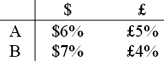

Consider the situation of firm A and firmB. The current exchange rate is $2.00/£ Firm A is a U.S. MNC and wants to borrow £30 million for 2 years. Firm B is a British MNC and wants to borrow $60 million for 2 years. Their borrowing opportunities are as shown, both firms have AAA credit ratings.  The IRP 1-year and 2-year forward exchange rates are

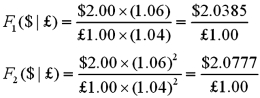

The IRP 1-year and 2-year forward exchange rates are

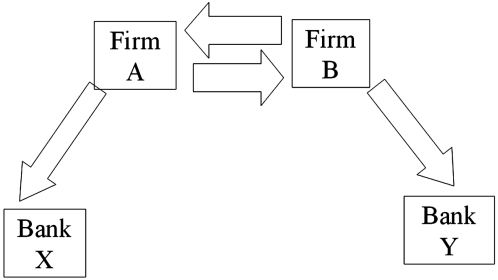

Devise a direct swap for A and B that has no swap bank. Show their external borrowing. Answer the problem in the template provided.

Devise a direct swap for A and B that has no swap bank. Show their external borrowing. Answer the problem in the template provided.

Definitions:

Different Languages

Refers to the variety of linguistic systems or forms of communication used by people around the world to convey thoughts, emotions, and information.

Repetitive Strings

Sequences of characters or symbols that are repeated multiple times in a specific pattern, often studied in computer science and linguistics.

Language Development

How youngsters grasp and use language in the initial stages of life.

Babbling

Babbling is an early stage of language development in infants, characterized by the production of sounds, syllables, and simple combinations thereof, often seen as a precursor to the development of actual spoken language.

Q1: Find the euro-zone cost of capital to

Q5: International banks are different from domestic banks

Q22: Following Honda's FDI in the U.S.,<br>A)the U.S.

Q23: Which factors appear to be fueling the

Q26: With regard to a swap bank acting

Q40: If the domestic currency is strong or

Q60: The market capitalization of the developed world<br>A)is

Q69: Which of the following would be an

Q84: Assuming that the bond sells at par,

Q98: Find the debt-to-value ratio for a firm