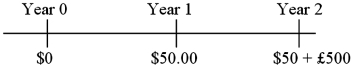

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S. dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity. The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

Definitions:

Stock Split

A corporate action that increases the number of a corporation's outstanding shares by dividing each share, which in turn reduces its price but not the total market capitalization.

Total Market Value

The aggregate value of a company or an asset in the marketplace, based on current prices and the total number of shares or units outstanding.

Stock Split

A corporate action where a company divides its existing stock into multiple shares to boost the liquidity of the shares.

Shares Outstanding

The cumulative amount of a company's shares that have been approved, distributed, and acquired by shareholders and currently possessed by them.

Q3: Find the price of a 30-year zero

Q20: Advantages of cross-listing include:<br>A)This decision provides their

Q21: In a push to serve the North

Q30: Developing multiple production sites in a variety

Q45: In evaluating the pros and cons of

Q50: Estimate your exposure (b) to the exchange

Q67: Under which method does the gain or

Q81: With regard to foreign currency translation methods

Q90: Cross-border acquisition involves<br>A)building new production facilities in

Q97: Yankee stocks<br>A)often trade as ADRs and have