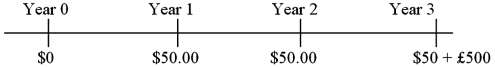

Find the value of a three-year dual currency bond with annual coupons (paid in U.S. dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity. The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

Definitions:

Kidney Damage

Harm or impairment of kidney function, which can result from various causes including disease, infection, or physical injury.

Aldosterone

A hormone produced by the adrenal gland that helps regulate blood pressure by controlling sodium and potassium levels in the blood.

High Blood Pressure

A condition where the force of the blood against the walls of blood vessels is consistently too high, leading to health risks.

Sodium

A chemical element with symbol Na and atomic number 11, essential for human health, primarily found in the extracellular fluid.

Q12: Eurobonds sold in the United States may

Q21: From the perspective of a corporate CFO,

Q26: Suppose you are a euro-based investor who

Q30: A stop order is an order to

Q34: A specialist on the NYSE<br>A)is obliged to

Q69: Under the current/noncurrent method<br>A)a foreign subsidiary with

Q75: Your firm is a Swiss importer of

Q81: Open interest in currency futures contracts<br>A)tends to

Q84: The sale of new common stock by

Q89: Eurobonds are usually<br>A)bearer bonds.<br>B)registered bonds.<br>C)bulldog bonds.<br>D)foreign currency