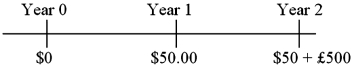

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S. dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity. The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

Definitions:

Serotonin

A neurotransmitter associated with mood regulation, happiness, and anxiety control.

Neurotransmitter

Chemical substances in the brain that transmit signals from one neuron to another across synapses.

Amnesia

A condition in which a person is unable to remember important information or experiences, typically due to trauma or medical conditions.

Serotonin

A chemical messenger that plays a crucial role in regulating mood, digestive functions, and sleep patterns.

Q30: The "reporting currency" is defined in FASB

Q37: Hedge fund advisors typically receive a management

Q49: You are the debt manager for a

Q49: Draw the binomial tree for this option.

Q61: XYZ Corporation, located in the United States,

Q65: The Wall Street Journal publishes daily values

Q68: Suppose the quote for a five-year swap

Q80: The key factors that are important in

Q89: The expected value of the investment in

Q91: For European currency options written on euro