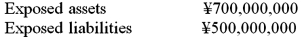

Consider a U.S.-based MNC with manufacturing activities in Japan. The result of a change in the ¥-$ exchange rate on the assets and liabilities of the consolidated balance sheet is:  Ignoring transaction exposure in the yen, the translation exposure will indicate a possible need for a "derivatives hedge" of

Ignoring transaction exposure in the yen, the translation exposure will indicate a possible need for a "derivatives hedge" of

Definitions:

Potential

An individual's or entity's inherent ability or capacity to develop, grow, and achieve success in the future.

Prosperous Economy

Characterizes an economic state with significant growth, wealth, and good living conditions for its populace.

Hierarchical Control

A method of management where decision-making authority is distributed on a graded scale from top-level management down to lower levels.

Organizational Design

The process of structuring an organization's roles, responsibilities, and systems to achieve its goals efficiently and effectively.

Q4: Your firm is an Italian exporter of

Q11: Find the cost today of your hedge

Q37: Suppose the quote for a five-year swap

Q40: Explain how firm A could use two

Q43: Eurocredits<br>A)are credit cards that work in the

Q55: Your U.S. firm has a £100,000 payable

Q72: Your firm is an Italian exporter of

Q75: The underlying principle of the temporal method

Q76: If the annual inflation rate is 5.5

Q86: Find the risk neutral probability of an