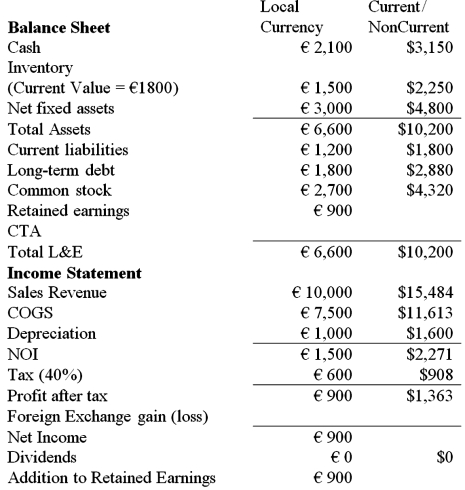

Find the foreign currency gain or loss for this U.S. MNC translating the balance sheet and income statement of a French subsidiary, which keeps its books in euro, but that is translated into U.S. dollars using the current/noncurrent method, the reporting currency of the U.S. MNC.

The subsidiary is at the end of its first year of operation.

The historical exchange rate is $1.60/€1.00 and the most recent exchange rate is $1.50/€

Definitions:

Variable Costs

Expenses that change in proportion to the activity of a business, such as materials and labor costs that increase with production volume.

Book Value

The value of an asset according to its balance sheet account balance, taking into account the cost of the asset minus its depreciation.

Variable Costs

Costs that change in proportion to the level of production or sales activity, such as raw materials and direct labor.

Production Time

The total time required to manufacture a product, from the start of production to the final product being ready for sale.

Q19: Generally unfavorable evidence on PPP suggests that<br>A)substantial

Q24: The current spot exchange rate is $1.55

Q32: A ten-year Floating-rate note (FRN) has coupons

Q42: A major risk faced by a swap

Q46: To hedge a foreign currency receivable,<br>A)buy call

Q51: In what year were U.S. MNCs mandated

Q53: The turnover ratio percentages for 27 equity

Q62: In a currency swap<br>A)it may be the

Q69: The most popular way for a U.S.

Q72: If you had €1,000,000 and traded it