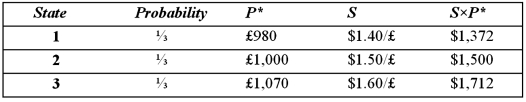

Suppose a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

Definitions:

Person Perception

The process by which individuals form judgments and impressions of others.

General Process

A series of actions or steps taken in order to achieve a particular end, applicable across various contexts or fields.

Communication Competency

The ability to effectively convey information, understand others, and interpret messages in both verbal and non-verbal forms.

Hand Gestures

Physical movements of the hands used to convey messages or meanings without the use of spoken words, varying significantly across cultures.

Q17: When exchange rates change,<br>A)U.S. firms that produce

Q31: Why do managers tend to retain free

Q38: A "call market"<br>A)is OTC and over-the-phone.<br>B)features an

Q40: Explain how firm A could use two

Q60: ABC Inc., an exporting firm, expects to

Q68: Self-interested managers may be tempted to<br>A)indulge in

Q89: If the annual inflation rate is 2.5

Q90: Many of the larger the larger emerging

Q94: XYZ Corporation enters into a 6-year interest

Q98: It can be argued that, while financial