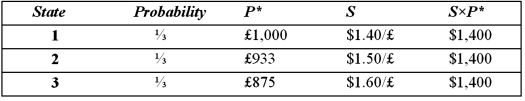

Suppose a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

Definitions:

Tutoring

The act of providing individualized instruction or assistance to a student or learner in a specific subject area to improve their understanding or performance.

Economics Test

An examination or assessment aimed at evaluating understanding or knowledge in the subject of economics.

Marginal Analysis

Assessing the supplementary gains of an activity against its incremental costs.

Particular Activity

A specific action or task typically carried out to achieve a defined purpose.

Q2: What would be the interest rate?

Q17: Concentrated ownership of a public company<br>A)can be

Q30: In many countries with concentrated ownership<br>A)the conflicts

Q36: Straight fixed-rate bond issues have<br>A)a designated maturity

Q38: Why would a U.S. bank open a

Q45: The sensitivity of "realized" domestic currency values

Q45: The variability of the dollar value of

Q61: If you borrowed €1,000,000 for one year,

Q88: In any given year, about what percent

Q94: A five-year, 4 percent Euroyen bond sells