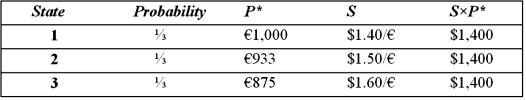

Suppose a U.S. firm has an asset in Italy whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. Calculate your cash flows in each of the possible states.

Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. Calculate your cash flows in each of the possible states.

Definitions:

Supporting Points

Information or evidence provided to strengthen an argument or proposition, making the main idea more convincing.

Findings Section

A portion of a report or document where the results of an investigation or research are presented and explained.

Talking Heads

A slang term for commentators or pundits who are frequently seen on television news shows, often providing opinions or analysis.

Alternatives

Different options or choices available in a given situation, offering distinct paths to a solution or decision.

Q5: A call option to buy £10,000 at

Q7: State the composition of the replicating portfolio;

Q11: Companies domiciled in countries with weak investor

Q11: FASB 8<br>A)required taking foreign exchange gains or

Q15: Find the risk-neutral probability of an "up"

Q44: A firm may cross-list its share to<br>A)establish

Q63: The current/noncurrent method of foreign currency translation

Q85: The extent to which the value of

Q93: The coupon interest on Eurobonds<br>A)is paid annually.<br>B)is

Q96: The variance of the exchange rate is:<br>A)0.001968<br>B)0.002969<br>C)0.003968<br>D)0.004968