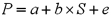

On the basis of regression Equation  we can decompose the variability of the dollar value of the asset, Var(P) , into two separate components Var(P) = b2 × Var(S) + Var(e) . The second term in the right-hand side of the equation, Var(e) represents.

we can decompose the variability of the dollar value of the asset, Var(P) , into two separate components Var(P) = b2 × Var(S) + Var(e) . The second term in the right-hand side of the equation, Var(e) represents.

Definitions:

Expected Rate

An anticipated return on investment, interest rate, or growth rate based on historical data, market analysis, or other predictive models.

Probability

This refers to the likelihood of occurrence of an uncertain event, often expressed as a number between 0 and 1.

Narrowest Bell Curve

Describes a distribution with a high peak and steep sides, indicating that the data points cluster closely around the mean, showing low variability.

Large-company Stocks

Equities issued by corporations with a large market capitalization, often considered more stable investments than those of smaller companies.

Q8: Consider a U.S.-based MNC with manufacturing activities

Q12: A U.S. firm has sold an Italian

Q13: The €/$ spot exchange rate is $1.50/€

Q40: If the domestic currency is strong or

Q46: Academic studies tend to discredit the validity

Q51: The models that the credit rating firms

Q54: A "specialist"<br>A)makes a market by holding an

Q70: Merchant banks are different from traditional commercial

Q75: Your firm is a Swiss importer of

Q77: In the CURRENCY TRADING section of The