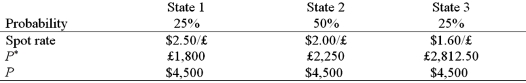

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

-The expected value of the investment in U.S. dollars is:

Definitions:

Indirect Indicator

A measure or sign that suggests a situation or condition's status without directly measuring it.

Subjective Measures

Assessments based on personal opinions, interpretations, or perspectives rather than objective criteria.

Superiors

Individuals who hold a higher position or rank within an organization, often responsible for overseeing the work of subordinates.

Effectiveness

The measure of effectiveness in realizing an intended or desired outcome.

Q11: Find the cost today of your hedge

Q12: Suppose that you are the treasurer of

Q14: The J. P. Morgan and Company Global

Q22: Using the temporal method, monetary accounts such

Q53: Consider a 1-year call option written on

Q54: FASB 8 is essentially the<br>A)current/noncurrent method.<br>B)monetary/nonmonetary method.<br>C)temporal

Q70: Your firm is a U.K.-based exporter of

Q71: The four currencies in which the majority

Q77: Outside the United States and the United

Q81: An affiliate bank is<br>A)a locally incorporated bank