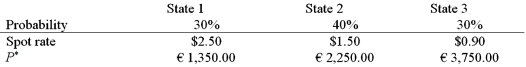

A U.S. firm holds an asset in Italy and faces the following scenario:  Where P* = Euro price of the asset held by the U.S. firm

Where P* = Euro price of the asset held by the U.S. firm

The CFO decides to hedge his exposure by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. As a result

Definitions:

Literature

The body of written works of a language, period, or culture, encompassing fiction, non-fiction, poetry, and other forms of written expression.

College Classes

Educational courses offered at the tertiary level by colleges or universities, designed to provide knowledge and skills in various academic or vocational subjects.

Women of Color

A term used to describe female individuals who are from non-white racial or ethnic backgrounds, emphasizing their unique experiences of discrimination and empowerment.

Human Difference

The variation and diversity among humans in aspects such as culture, ethnicity, race, gender, sexuality, physical abilities, and beliefs.

Q10: Comparing "forward" and "futures" exchange contracts, we

Q46: A bank agrees to buy from a

Q54: A "specialist"<br>A)makes a market by holding an

Q61: Using the table what is the 6-month

Q65: Explain how this opportunity affects which swap

Q67: The AUD/$ spot exchange rate is AUD1.60/$

Q71: A measure of liquidity for a stock

Q77: A study of Fortune 500 firms hedging

Q81: Suppose that you implement your hedge from

Q89: Suppose that the exchange rate is €1.25