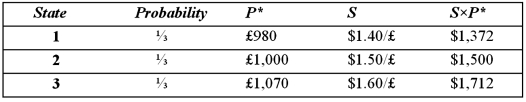

Suppose a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

Definitions:

Worth

The value or importance of something, often measured in terms of money or utility.

Marginal Utility

The additional satisfaction or utility received by a consumer from consuming one more unit of a good or service.

Consumer Surplus

The divergence between the sum consumers are prepared and financially capable to pay for a good or service and the sum they actually disburse.

Marginal Utility

The extra pleasure or benefit received from using an additional unit of a product or service.

Q1: The LIBOR rate for euro<br>A)is EURIBOR.<br>B)is a

Q6: Multinational banks are often not subject to

Q13: Draw the tree for a put option

Q17: Using the table, what is 3-month forward

Q29: Which of the following are correct?<br>A) <img

Q40: Which of the following is a translation

Q62: A purely domestic firm that sources and

Q76: Today's settlement price on a Chicago Mercantile

Q86: Generating exchange rate forecasts with the fundamental

Q93: If you borrowed $1,000,000 for one year,