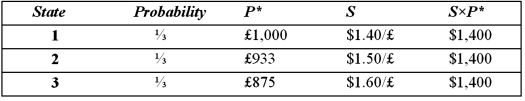

Suppose a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

Definitions:

Competitive Advantages

Unique attributes or capabilities that allow a company to outperform rivals, create greater value for its customers, and achieve superior market position.

Straddling

A strategy where a company seeks to occupy more than one position in a market or industry, often attempting to offer a range of products or services to cover different segments.

Marketing Failure

Marketing failure occurs when a marketing plan fails to achieve its objectives, leading to wasted resources, lost opportunities, or negative impact on a company's brand.

Target Drift

The phenomenon where the intended target market or audience gradually changes over time, impacting marketing strategies.

Q1: Under the current rate method,<br>A)income statement items

Q10: When managerial self-dealings are excessive and left

Q12: A forward rate agreement (FRA) is a

Q28: Find the input d<sub>1</sub> of the Black-Scholes

Q54: A correspondent bank relationship is established when<br>A)two

Q59: Tobin's Q is<br>A)the ratio of the market

Q76: ADR trades<br>A)clear in three days, just like

Q82: In theory,<br>A)managers are hired by the shareholders

Q88: The firm may not be subject to

Q100: When designing an incentive contract,<br>A)it is important