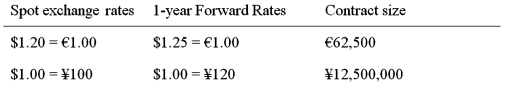

A Japanese EXPORTER has a €1,000,000 receivable due in one year. Spot and forward exchange rate data is given in the table:  The one-year risk free rates are i$ = 4.03%; i€ = 6.05%; and i¥ = 1%. Detail a strategy using forward contract that will hedge exchange rate risk.

The one-year risk free rates are i$ = 4.03%; i€ = 6.05%; and i¥ = 1%. Detail a strategy using forward contract that will hedge exchange rate risk.

Definitions:

Null Hypothesis

The default hypothesis in statistical testing that assumes no effect or difference, stating that any observed variability is due to chance.

Directional

Pertains to hypothesis testing or research questions that specify the direction of the expected relationship or difference between variables.

Entire Population

Refers to all members or elements of a defined group or category that a researcher is studying.

Null Hypothesis

A hypothesis in statistical analysis that suggests there is no effect or no difference, and it serves as a starting assumption for testing.

Q2: XYZ Corporation, located in the United States,

Q26: Consider the balance sheets of Bank A

Q31: Which of the following can a company

Q37: With a bearer bond,<br>A)possession is evidence of

Q39: Calculate the hedge ratio.

Q40: Transactions in shares of the iShares Funds

Q58: There is (at least) one profitable arbitrage

Q73: Contingent exposure can best be hedged with<br>A)options.<br>B)money

Q82: When a currency trades at a discount

Q92: What is the ASK cross-exchange rate for