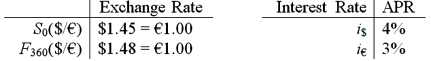

Suppose you observe the following 1-year interest rates, spot exchange rates and futures prices. Futures contracts are available on €10,000. How much risk-free arbitrage profit could you make on 1 contract at maturity from this mispricing?

Definitions:

Garments

Clothing items or articles of dress; may also relate to the industry involved in designing and selling clothes.

Rental Expense

Rental Expense refers to the cost incurred for renting a property or equipment, categorized as an operating expense in financial accounting.

Square Feet

A measure of area used primarily in the United States, equivalent to the area of a square with sides one foot in length.

Advertising Cost

The expense incurred by a business to promote its products, services, or brand through various media channels.

Q20: A bank bought a "three against six"

Q40: Your firm is a U.K.-based importer of

Q48: The underlying philosophy of the monetary/nonmonetary method

Q68: Which equation is used to define the

Q73: By far the most important international finance

Q78: The secondary market for Eurobonds<br>A)is an over-the-counter

Q82: Proceeding the Asian crisis,<br>A)domestic price bubbles in

Q83: The primary activities of offshore banks<br>A)include money

Q85: The extent to which the value of

Q86: When Honda, a Japanese auto maker, built