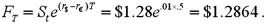

Assume that the dollar-euro spot rate is $1.28 and the six-month forward rate is  The six-month U.S. dollar rate is 5% and the Eurodollar rate is 4%. The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

The six-month U.S. dollar rate is 5% and the Eurodollar rate is 4%. The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

Definitions:

Folds

Folds are bends or creases in a material made by doubling it over itself or by compressing.

Effects

Outcomes or results that are caused by some preceding action or cause.

Managable

Capable of being controlled, handled, or dealt with easily.

Society

A structured community of people bound together by similar traditions, institutions, or nationality.

Q1: The LIBOR rate for euro<br>A)is EURIBOR.<br>B)is a

Q15: There are two types of equity related

Q24: Government controlled investment funds, known as sovereign

Q31: FASB 52 requires<br>A)the current rate method of

Q48: The current spot exchange rate is $1.55/€

Q52: Translation exposure,<br>A)is not entity specific, rather it

Q61: In reference to capital requirements, value-at-risk analysis<br>A)refers

Q66: Generally speaking, any transaction that results in

Q72: If you had €1,000,000 and traded it

Q93: Why is it rational to make shareholders