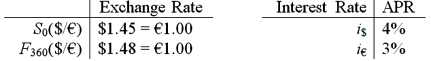

Suppose you observe the following 1-year interest rates, spot exchange rates and futures prices. Futures contracts are available on €10,000. How much risk-free arbitrage profit could you make on 1 contract at maturity from this mispricing?

Definitions:

Proximal Socialization Outcomes

Immediate results that stem from the process of adapting and integrating into a new social environment or group.

Distal Socialization Outcomes

The long-term results of the socialization process, such as the integration into and acceptance by an organization’s culture.

Orientation Program

A structured introduction offered by an organization to acquaint new employees with its policies, procedures, culture, and the roles they will be assuming.

Workplace Stressors

Factors or conditions in the workplace that can cause stress to employees.

Q28: When determining the functional currency,<br>A)if the sales

Q30: The moving average crossover rule<br>A)is a fundamental

Q32: The exposure coefficient <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2454/.jpg" alt="The exposure

Q35: An Offshore banking center is<br>A)a country whose

Q59: Publicly traded Yankee bonds must<br>A)meet the same

Q75: Bank dealers in conversations among themselves use

Q77: Outside the United States and the United

Q80: The cost of compliance with the Sarbanes-Oxley

Q99: The most important international reserve asset, comprising

Q102: The current exchange rate is £1.00 =