Multiple Choice

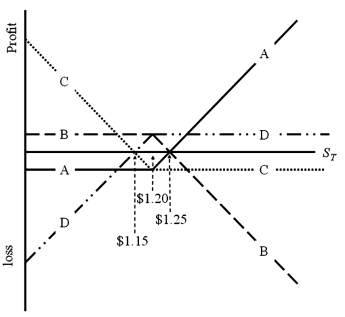

Which of the lines is a graph of the profit at maturity of writing a call option on €62,500 with a strike price of $1.20 = €1.00 and an option premium of $3,125?

Definitions:

Related Questions

Q3: Which of the following conclusions are correct?<br>A)Most

Q11: Find the cost today of your hedge

Q14: The $/CD spot bid-ask rates are $0.7560-$0.7625.

Q16: Suppose that the annual interest rate is

Q17: The impact of financing in determining the

Q41: The board of directors may grant stock

Q59: The current spot exchange rate is $1.45/€

Q67: ABC Inc., an exporting firm, expects to

Q77: Outside the United States and the United

Q79: A five-year floating-rate note has coupons referenced