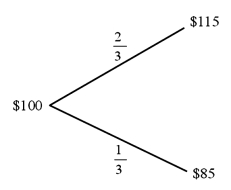

Find the value of a call option written on €100 with a strike price of $1.00 = €1.00. In one period there are two possibilities: the exchange rate will move up by 15% or down by 15% . The U.S. risk-free rate is 5% over the period. The risk-neutral probability of dollar depreciation is 2/3 and the risk-neutral probability of the dollar strengthening is 1/3.

Definitions:

Real Estate Brokerage

A service involved in arranging the buying, selling or renting out of properties, utilizing agents or brokers to facilitate transactions between buyers and sellers.

Mortgages

Loans specifically used for purchasing real estate, where the property itself serves as collateral to secure the loan.

Liabilities and Net Worth

The total of all debts and obligations owed by an entity minus its total assets, portraying the entity's financial health and capital.

Efficient Market Hypothesis

The theory that all available information is already reflected in asset prices, thereby making it impossible to consistently achieve higher returns.

Q8: Consider a U.S.-based MNC with manufacturing activities

Q17: Current account includes<br>A)(i), (ii), and (iii)<br>B)(ii), (iii),

Q29: A higher U.S. interest rate (i<sub>$</sub> ↑)

Q33: The "exposure" (i.e. the regression coefficient beta)

Q43: The source of translation exposure<br>A)is a mismatch

Q65: The Wall Street Journal publishes daily values

Q65: A firm that is committed to keeping

Q68: Edge Act banks<br>A)are not prohibited from owning

Q84: For European currency options written on euro

Q94: A five-year, 4 percent Euroyen bond sells