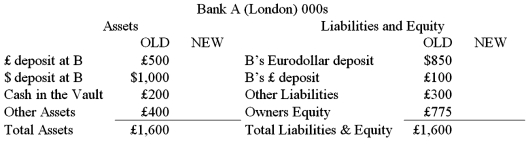

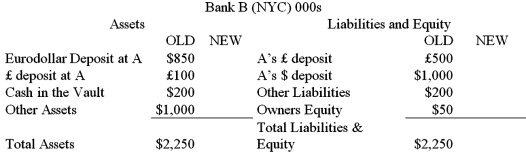

Consider the balance sheets of Bank A and BankB. Bank A is in London, Bank B is in New York. The current exchange rate is £1.00 = $2.00. Show the correct balances in each account if a currency trader employed at Bank A buys £45,000 from a currency trader at Bank B for $90,000 using its correspondent relationship with BankB.

Definitions:

Loan Payoff Requirement

The terms or conditions under which a borrower is obliged to repay the principal and interest on a loan.

Debt Free Period

A timeframe during which an individual or organization has fully paid off all outstanding debts, owing no money to creditors.

Warehouse Receipts

Documents that provide proof of ownership of commodities (like grain, metals, etc.) stored in a warehouse.

Trust Receipts

Trust receipts are documents that evidence the release of merchandise to a buyer in trust for the bank until the loan amount is paid.

Q6: In Japan, the racketeers who demand payment

Q13: The main characteristic(s) of leveraged restructurings is

Q15: Consider a three-tier pyramid and a single

Q28: In countries with concentrated ownership<br>A)hostile takeovers are

Q37: More important than he absolute size of

Q40: Leveraged restructurings are designed to force mature,

Q48: In the figure at right, label curves

Q49: In Japan, a keiretsu is a network

Q68: The current exchange rate is £1.00 =

Q91: The ultimate guardians of shareholder interest in