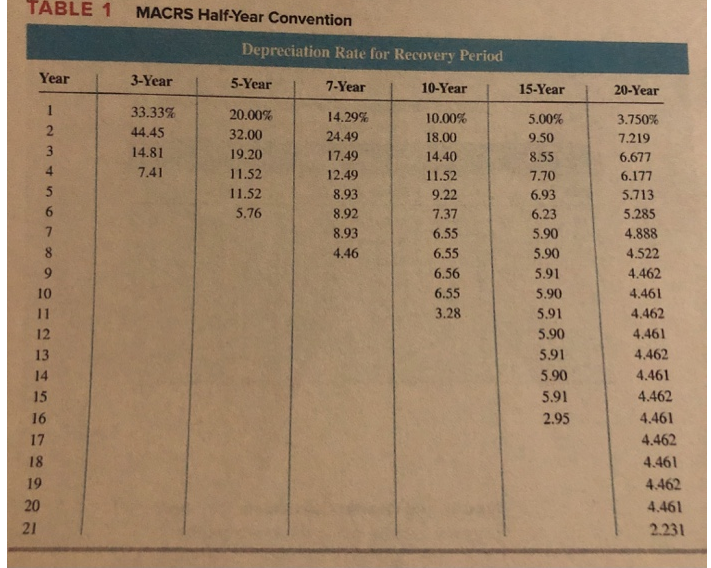

MACRS Table1

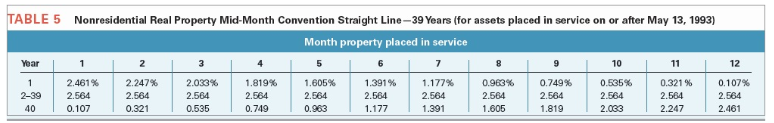

MACRS Table5

Exhibit 10-10 IN THE TEXT

-Boxer LLC has acquired various types of assets recently used 100% in its trade or business.Below is a list of assets acquired during 2017 and 2018:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017,but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2018.(Use MACRS Table 1,Table 5 and Exhibit 10-10 )(Round final answer to the nearest whole number.)

Definitions:

Revenue Variance

The difference between actual revenue and budgeted or forecasted revenue, indicating a company's financial performance.

Flexible Budget

A budget that adjusts to changes in volume or activity level, allowing for better performance analysis and control.

Customers Served

Customers served denotes the number of individuals or entities that have received or benefited from a company's products or services.

Laundry Costs

Expenses associated with cleaning textile products, such as clothing, linens, and uniforms.

Q7: Employees are allowed to deduct a portion

Q18: A loss deduction from a casualty of

Q56: Jamie is single.In 2018,she reported $100,000 of

Q58: Otter Corporation reported taxable income of $400,000

Q65: Adjusted taxable income is defined as follows

Q69: A distribution from a corporation to a

Q92: Luke sold land valued at $210,000.His original

Q95: Tammy owns 60 percent of the stock

Q103: Harmony is single and was self-employed for

Q109: Half Moon Corporation made a distribution of