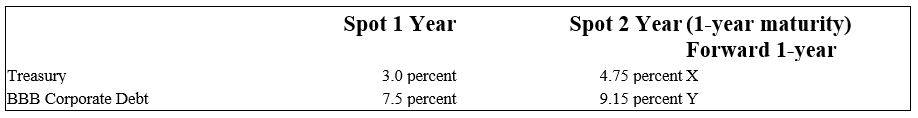

The following is information on current spot and forward term structures (assume the corporate debt pays interest annually) :

-The duration of a soon to be approved loan of $10 million is four years.The 99th percentile increase in risk premium for bonds belonging to the same risk category of the loan has been estimated to be 5.5 percent. What is the capital (loan) risk of the loan if the current average level of interest rates for this category of bonds is 12 percent?

Definitions:

Garbage

Waste material that is discarded by humans, typically due to its inability to be used again or lack of perceived value.

Commodities

Basic goods used in commerce that are interchangeable with other goods of the same type, often used as inputs in the production of other goods or services.

Prices

The monetary value assigned to goods or services, representing the amount a buyer pays to a seller in a market transaction.

Income

The income earned, usually periodically, from labor or investment returns.

Q40: Adjusting interest rates,fees,and other terms upward for

Q43: Which of the following situations pose a

Q43: If an FI's repricing gap is less

Q65: Recessionary phases in the business cycle typically

Q67: Which of the following insurance products protects

Q74: Life insurance guaranty funds<br>A)are sponsored by state

Q82: What is the impact on net interest

Q94: An indirect quote of a foreign currency

Q112: Overaggregation within maturity buckets using the repricing

Q116: When the Fed finds it necessary to