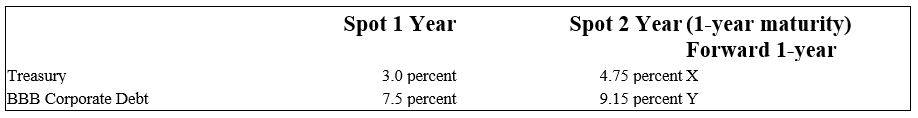

The following is information on current spot and forward term structures (assume the corporate debt pays interest annually) :

-The cumulative probability of repayment of BBB corporate debt over the next two years is

Definitions:

Negative Exponential Curve

A type of mathematical curve that decreases rapidly at first and then levels off, often used to describe decay processes or failure rates.

Coefficient

A numerical value or constant that defines the relationship between two variables in mathematical equations or models, indicating how one variable changes in relation to another.

Repetitions

The action of repeating something, such as an exercise or task, multiple times to improve proficiency, strength, or conditioning.

Q20: If a bank's concentration limit (as a

Q30: The repricing model ignores market value effects

Q42: When comparing banks and mutual funds,<br>A)mutual funds

Q45: What is the FI's interest rate risk

Q66: An FI has $5 million in cash

Q70: Even with liquidity planning,net deposit withdrawals and/or

Q84: The risk that a debt security's price

Q102: Separate accounts business represents those policies and

Q106: Which function of an FI involves buying

Q112: When does "duration" become a less accurate