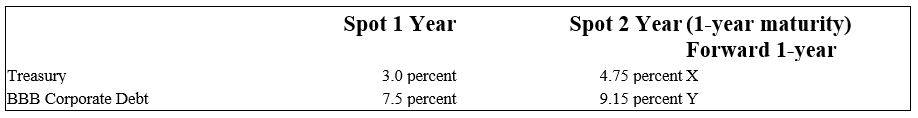

The following is information on current spot and forward term structures (assume the corporate debt pays interest annually) :

-The duration of a soon to be approved loan of $10 million is four years.The 99th percentile increase in risk premium for bonds belonging to the same risk category of the loan has been estimated to be 5.5 percent. What is the estimated risk-adjusted return on capital (RAROC) of this loan.

Definitions:

Q13: Estimate the standard deviation of Bank B's

Q18: One of the weaknesses of estimating expected

Q40: In the LCD and EM debt markets,sovereign

Q47: A possible reason for the high systematic

Q74: It is impossible for money market mutual

Q75: What is the effect on the value

Q76: The short-term debt consists of 4-year bonds

Q100: Calculate the value of x (the implied

Q102: Which of the following is an example

Q112: In general,maximum levels of losses in the