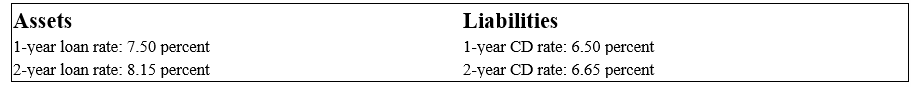

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.

-If the FI finances a $500,000 2-year loan with a $400,000 1-year CD and equity,what is the leveraged adjusted duration gap of this position? Use your answer to the previous question.

Definitions:

Self-recognition

The cognitive ability to recognize oneself in a mirror or photograph, demonstrating an awareness of the self as distinct from others.

18-24 Months

A developmental age range for toddlers characterized by significant growth in motor skills, language acquisition, and independence.

8-12 Months

A developmental period marked by significant achievements like crawling, standing, and possibly beginning to walk, as well as stranger anxiety and attachment to caregivers.

Delay Of Gratification

The ability to resist the temptation for an immediate reward and wait for a later reward.

Q12: Using the term structure of default probabilities,the

Q12: Off-balance-sheet risk occurs because of activities that

Q32: What is the expected probability of default

Q35: The type of abusive activity that involves

Q65: A weakness of migration analysis to evaluate

Q72: When the assets and liabilities of an

Q76: The decline in European FX volatility during

Q104: What is this bank's interest rate risk

Q105: Credit rationing by an FI<br>A)involves restricting the

Q123: An advantage FIs have over individual household