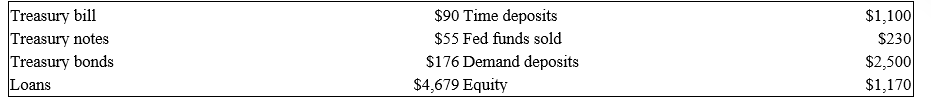

The numbers provided by Fourth Bank of Duration are in thousands of dollars.

Notes: All Treasury bills have six months until maturity.One-year Treasury notes are priced at par and have a coupon of 7 percent paid semiannually.Treasury bonds have an average duration of 4.5 years and the loan portfolio has a duration of 7 years.Time deposits have a 1-year duration and the Fed funds duration is 0.003 years.Fourth Bank of Duration assigns a duration of zero (0) to demand deposits.

-If the relative change in interest rates is a decrease of 1 percent,calculate the impact on the bank's market value of equity using the duration approximation. (That is, R/(1 + R) = -1 percent)

Definitions:

Price-taker Firm

A firm that has no control over the market price and must accept the prevailing market price for its products.

Marginal Revenue

The extra revenue generated by the sale of an additional unit of a product or service.

Marginal Cost

The cost of producing one additional unit of a product or service.

Average Variable Cost

The total variable expenses divided by the number of units produced, representing the variable cost per unit.

Q8: What does the Moody's Analytics model use

Q14: The chief compliance officer of a mutual

Q14: Abnormally large and unexpected deposit withdrawals can

Q18: In terms of liquidity risk measurement,the financing

Q29: Government securities represent the reserve asset fund

Q33: FI regulators are not concerned with insolvency

Q64: The primary difficulty in arranging a syndicated

Q65: An insurance policy that often is the

Q92: Credit scoring models include all of the

Q96: Suppose a pension fund must have $10,000,000