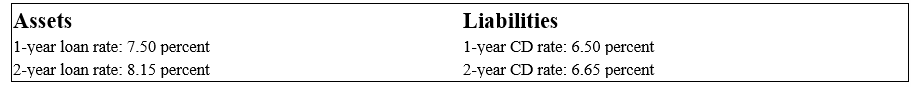

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.

-If the FI finances a $500,000 2-year loan with a $400,000 1-year CD and equity,what is the leveraged adjusted duration gap of this position? Use your answer to the previous question.

Definitions:

Advanced Cancer

A stage of cancer where the disease has progressed to a point where it is considered significantly advanced and often difficult to treat.

Bacterial Infections

Diseases caused by bacteria, which are microscopic organisms that can lead to various illnesses.

Reduced Immune Responses

Describes a weakened ability of the immune system to fight off infections or diseases.

Perceived Control

An individual's belief in their capability to influence events in their own lives, which can affect their psychological well-being.

Q10: The risk that an investor will be

Q14: An FI can control its FX risk

Q17: All fixed-income assets exhibit convexity in their

Q32: Your U.S.bank issues a one-year U.S.CD at

Q37: Equity mutual funds may contain common stock,but

Q57: Foreign exchange rate risk occurs because foreign

Q70: Insurance guarantee funds are administered by federal

Q76: The front-end load on these type of

Q83: The spot foreign exchange market is where

Q90: All other things equal,longer term loans are