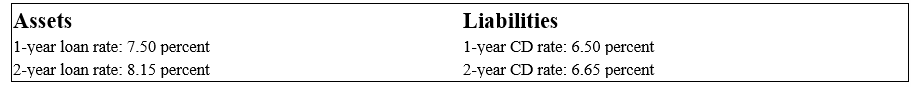

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.

-If interest rates increase by 20 basis points (i.e. , R = 20 basis points) ,use the duration approximation to determine the approximate price change for the Treasury note.

Definitions:

Salvage Value

The anticipated market value of an asset upon completing its service life.

Matching Principle

An accounting principle that requires expenses to be matched with the revenues they helped to generate in the same period.

Amortization

The gradual reduction of a debt over a period of time or the spreading out of capital expenses related to intangible assets over their useful life.

Matching Principle

An accounting principle that dictates expenses should be recognized in the same period as the revenues they helped generate.

Q3: Which of the following observations is NOT

Q5: FIs typically are concerned about the value

Q11: Most demand deposits stay at DIs for

Q37: The use of an exchange rate forward

Q41: The risk premium,or spread,between corporate bonds and

Q71: A $1,000 six-year Eurobond has an 8

Q107: What type of risk focuses upon future

Q112: As of 2015,hedge fund managers with assets

Q113: The larger the interest rate shock,the smaller

Q122: Setting the duration of the assets higher