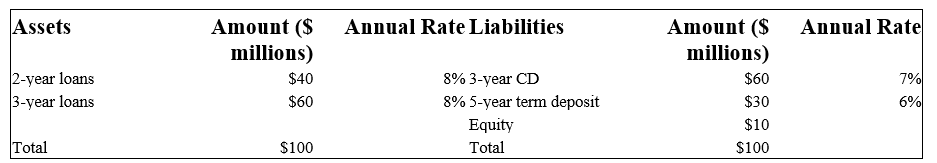

Duration Bank has the following assets and liabilities as of year-end. All assets and liabilities are currently priced at par and pay interest annually.

-What is the FI's maturity gap?

Definitions:

Interest-Rate Risk

The potential for investment losses due to changes in interest rates, affecting the value of interest-bearing assets like bonds.

Yield To Maturity

The total return expected on a bond if the bond is held until its maturity date.

Coupon Bond

A debt security that pays the holder a fixed interest amount (coupon) at scheduled intervals until the maturity date, when the principal amount is repaid.

Interest-Rate Risk

Interest-rate risk is the risk that changes in interest rates will negatively affect the value of an investment, particularly relevant for fixed-income securities.

Q13: Estimate the standard deviation of Bank B's

Q29: Included in the Moody's Analytics model are

Q47: What is the profit to the investment

Q50: An open-end bond mutual fund is holding

Q56: In the Moody's Analytics portfolio model,the expected

Q58: As part of measuring unobservable default risk

Q69: The Investment Advisors Act of 1940 sets

Q74: Hedge funds are forbidden to sell a

Q87: The risk that an FI may not

Q99: An FI can hold assets denominated in