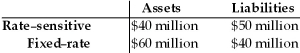

Table 23.2

First National Bank

-Refer to Table 23.2.Assuming that the average duration of the bank's assets is four years,while the average duration of its liabilities is three years,a rise in interest rates from 5 percent to 10 percent will cause the net worth of First National to ________ by ________ of the total original asset value.

Definitions:

Financial Bottom Line

A reference to the net income, profit, or loss reported at the bottom of a company's income statement.

Defining a Problem

The process of identifying and articulating an issue or challenge that needs to be addressed or solved.

Build a Better Mousetrap

An idiom suggesting the act of innovating or creating superior products or solutions to existing ones.

Get Rid of Mice

The process or methods employed to eliminate mice from an environment, often involving traps, poison, or exclusion techniques.

Q9: The partial expenditure multiplier<br>A) is the total

Q15: According to Keynesian coordination failure theory,the primary

Q22: What factors explain the existence of finance

Q23: When asset prices fall following a boom,<br>A)

Q26: The fact that insurance companies charge young

Q48: The major provisions of the Financial Institutions

Q51: What niche in the financial system do

Q70: Checkable deposits,a traditional source of low-cost funds

Q87: The regulatory system that has evolved in

Q114: Deposits in European banks denominated in dollars