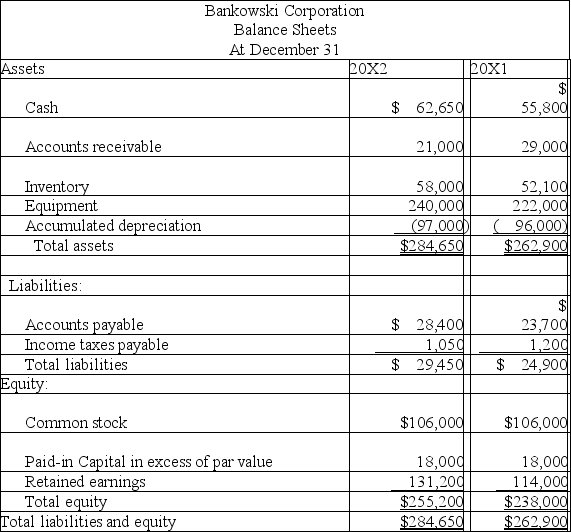

Based on the following income statement and balance sheet for Bankowski Corporation, determine the cash flows from operating activities using the indirect method.

Definitions:

Production Cost

Production cost is the total expense incurred in the process of creating goods or services, including raw materials, labor, and overhead costs.

Conversion Costs

Refers to the combined costs of direct labor and manufacturing overheads that are incurred to convert raw materials into finished goods.

Manufacturing Costs

Costs that are directly associated with the manufacturing of products, including raw materials, workforce expenses, and indirect costs.

Work in Process

Inventories that are currently in the production process and have not yet reached the final stage to be classified as finished goods.

Q24: The appropriate section in the statement of

Q24: Poe Company is considering the purchase

Q33: To determine a product selling price based

Q87: The salaries of employees who spend all

Q105: Horizontal analysis is used to reveal changes

Q109: Coffer Co. is analyzing two projects

Q129: A cash equivalent is:<br>A) An investment readily

Q153: Which of the following represents the correct

Q180: A purchase of land in exchange for

Q196: Investment center managers are typically evaluated using