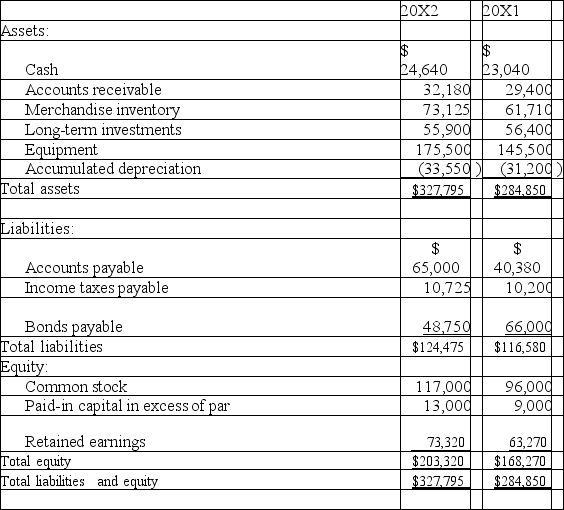

The following information is available for the Aarons Corporation:

Aarons Corporation

Balance Sheets

At December 31

Additional information:

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3) New equipment was purchased for $67,550 cash.

(4) Cash dividends of $33,600 were paid.

(5) Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 20X2 using the indirect method.

Definitions:

Expense Accounts

Accounts used to record the consumption of goods and services, or costs incurred in operating a business.

Adjusting Entry

A journal entry made at the end of an accounting period to allocate income and expenditure to the appropriate period for a more accurate financial statement.

Income Statement

A financial statement that reports a company's financial performance over a specific accounting period, detailing revenues, expenses, and profits or losses.

Prepaid Rent

An asset account that represents rent payments made in advance of the rental period.

Q26: Most managers stress the importance of understanding

Q52: Riemer, Inc. has four departments. Information

Q56: Two investments with exactly the same payback

Q96: When preparing the operating activities section of

Q140: A company had average total assets of

Q168: External users of financial information:<br>A) Are those

Q198: The cash flow on total assets ratio

Q203: Carducci Corporation reported Net sales of $3.6

Q221: Current assets minus current liabilities is:<br>A) Profit

Q224: A good financial report does not link