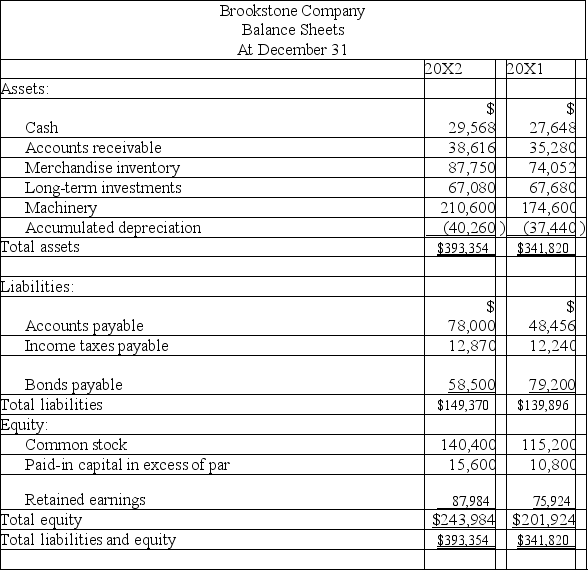

The Following Information Is Available for the Brookstone Company Additional Information:

(1) There Was No Gain or Loss on \text

The following information is available for the Brookstone Company:

Additional information:

Additional information:

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old machinery with an original cost of $45,060 was sold for $2,520 cash.

(3) New machinery was purchased for $81,060 cash.

(4) Cash dividends of $40,320 were paid.

(5) Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 20X2 using the indirect method.

Definitions:

Median Score

A statistical measure representing the middle value in a set of data, where half the numbers are above and half are below this point.

Test

an assessment intended to measure a test-taker's knowledge, ability, aptitude, physical fitness, or classification in many other topics.

Students

Individuals who are engaged in learning, especially those enrolled in educational institutions.

Mean Score

The average value of a set of numbers, calculated by dividing the sum of all the numbers by the count of numbers.

Q51: The debt ratio, the equity ratio, pledged

Q61: Ultimo Co. operates three production departments

Q66: The following transactions and events occurred during

Q73: Evaluation of company performance can include comparison

Q79: Current assets divided by current liabilities is

Q95: When using a spreadsheet to prepare the

Q130: Three of the most common tools of

Q159: In preparing a company's statement of

Q173: Cash flows from selling trading securities are

Q206: The comparison of a company's financial condition