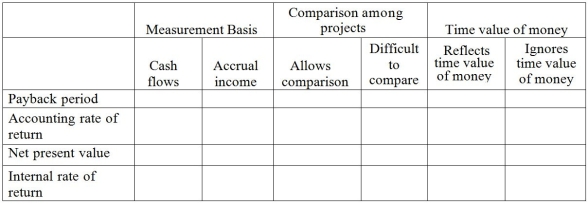

For each of the capital budgeting methods listed below, place an X in the correct column, indicating the measurement basis of each, the ability to make comparison among projects, and whether each method reflects or ignores the time value of money.

Definitions:

Marginal Tax Rate

Marginal Tax Rate is the rate at which the last dollar of income is taxed, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Total Income

The sum of all earnings and other forms of income received by an individual or entity over a period of time.

Average Tax Rate

The percentage of total income that is paid in taxes.

Marginal Tax Rate

The percentage of tax applied to your next dollar of income, indicating the rate at which your last dollar earned is taxed.

Q40: Alfarsi Industries uses the net present

Q73: Standard material costs, standard labor costs, and

Q135: Refer to the following selected financial

Q136: Capital budgeting is the process of analyzing

Q139: Ship Co. produces storage crates that require

Q152: A company's flexible budget for 12,000 units

Q156: The following is a partially completed

Q162: Which of the following is not part

Q192: The gain or loss from retirement of

Q237: The direct method of reporting operating cash