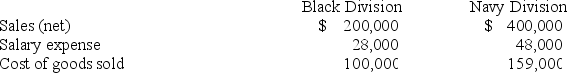

Marian Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

Definitions:

Equity Method

An accounting technique used by companies to record their investments in other companies, where the investment gives the investor significant influence over the investee, but not control or full ownership.

Additional Paid-in Capital

The excess amount over the par value that shareholders pay when shares are issued, recorded in the equity section of the balance sheet.

Q22: Which of the following factors is least

Q27: Gala Enterprises collected the following data regarding

Q39: A company has established 5 pounds of

Q45: Companies promoting continuous improvement strive to achieve

Q48: Identify at least three reasons for managers

Q85: Wheeler Company can produce a product that

Q120: How does the calculation of break-even time

Q131: Differential Chemical produced 10,000 gallons of Preon

Q170: The number and types of budgets included

Q184: Hatter, Inc. allocates fixed overhead at a