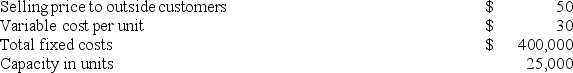

Division X makes a part that it sells to customers outside of the company. Data concerning this part appear below:  Division Y of the same company would like to use the part manufactured by Division X in one of its products. Division Y currently purchases a similar part made by an outside company for $49 per unit and would substitute the part made by Division X. Division Y requires 5,000 units of the part each period. Division X has ample excess capacity to handle all of Division Y's needs without any increase in fixed costs and without cutting into outside sales. According to the formula in the text, what is the lowest acceptable transfer price from the standpoint of the selling division?

Division Y of the same company would like to use the part manufactured by Division X in one of its products. Division Y currently purchases a similar part made by an outside company for $49 per unit and would substitute the part made by Division X. Division Y requires 5,000 units of the part each period. Division X has ample excess capacity to handle all of Division Y's needs without any increase in fixed costs and without cutting into outside sales. According to the formula in the text, what is the lowest acceptable transfer price from the standpoint of the selling division?

Definitions:

Tax Schedule

A chart or list that outlines the rates of taxation for different levels of income or types of taxpayers.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, demonstrating the percentage of tax applied to your income for each tax bracket in which you qualify.

Taxable Income

The income subject to taxes after deductions and exemptions.

Price Elasticity

The calculation of how price alterations affect the demand level of a good.

Q9: A(n) _ is a department that generates

Q39: A _ is the combination of products

Q53: You have evaluated three projects of similar

Q54: A special order of goods or services

Q67: The payback method of evaluating an investment

Q75: The Gardner Company expects sales for October

Q118: Wichita Industries' sales are 10% cash and

Q157: Long-term liability data for the budgeted balance

Q158: Rowan, Inc.'s, income statement is shown

Q162: Which of the following is not part