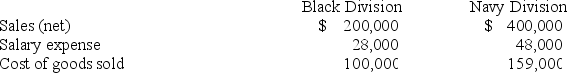

Marian Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

Definitions:

Working Capital

The difference between a company's current assets and current liabilities, indicating the liquidity of the business.

Acid-Test Ratio

The acid-test ratio, also known as the quick ratio, measures a company's ability to pay its short-term liabilities with its most liquid assets.

Quick Ratio

A liquidity measure indicating a company's ability to cover its current liabilities with its most liquid assets, excluding inventory.

Book Value Per Share

A financial metric showing the portion of a company's net asset value attributable to each share of stock.

Q3: A cost center does not directly generate

Q9: There is only one method of evaluating

Q12: In a make or buy decision, management

Q13: Ultimo Co. operates three production departments

Q67: The selling expenses budget is normally prepared

Q101: A company's flexible budget for 12,000 units

Q105: A sporting goods manufacturer budgets production of

Q153: Based on the information provided below for

Q183: Ratchet Manufacturing's August sales budget calls for

Q207: Explain the difference between direct and indirect