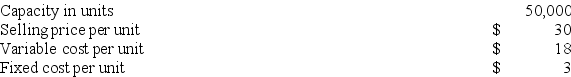

Division A produces a part with the following characteristics:  Division B, another division in the company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $28 per unit. If Division A sells to Division B, $1 in variable costs can be avoided. Suppose Division A is currently operating at capacity and can sell all of the units it produces on the outside market for its usual selling price. From the point of view of Division A, any sales to Division B should be priced no lower than:

Division B, another division in the company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $28 per unit. If Division A sells to Division B, $1 in variable costs can be avoided. Suppose Division A is currently operating at capacity and can sell all of the units it produces on the outside market for its usual selling price. From the point of view of Division A, any sales to Division B should be priced no lower than:

Definitions:

American Opportunity Tax Credit

A deduction for eligible educational expenses incurred for a qualifying student during the initial four years of post-secondary education.

Qualifying Expenses

Expenses that meet the criteria set by tax laws or other regulations for deductible or otherwise favorable treatment.

Child and Dependent Care Credit

A tax credit offered to taxpayers to offset the cost of care for qualifying dependents, enabling the taxpayer to work or look for work.

Qualified Day Care Center

A child care facility that meets specific criteria set by tax law, potentially eligible for certain tax benefits.

Q25: Direct materials variances are called price and

Q52: The responsibility for coordinating the preparation of

Q61: Firenze Company's fixed budget for the first

Q83: Identify the four steps in the budgetary

Q101: Maxim manufactures a hamster food product called

Q143: A company's flexible budget for 12,000 units

Q172: The reporting of investing and financing activities

Q173: Grason Corporation is preparing a budgeted balance

Q200: The most useful allocation basis for the

Q214: The following information comes from the records