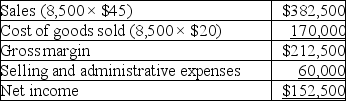

Wind Fall, a manufacturer of leaf blowers, began operations this year. During this year, the company produced 10,000 leaf blowers and sold 8,500. At year-end, the company reported the following income statement using absorption costing:  Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced) . Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced) . Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Definitions:

Optimal Order

The most efficient or cost-effective quantity of goods to order, taking into account factors such as demand, holding costs, and ordering costs.

Available Capacity

The amount of production capability or service availability that can be provided over a certain period of time.

Multiple Products

The strategy or situation of offering or managing a variety of different products instead of focusing on a single offering.

Postponement

A supply chain strategy that delays product customization or final assembly until customer orders are received, to reduce inventory costs and increase flexibility.

Q15: Assume that sales are predicted to be

Q15: Assuming fixed costs remain constant, and a

Q61: Firenze Company's fixed budget for the first

Q65: A company has established 5 pounds of

Q86: The production budget cannot be prepared until

Q144: How much overhead cost will be assigned

Q156: Tim's Tools, a manufacturer of cordless drills,

Q169: A company estimates that overhead costs for

Q201: Batch-level costs do not vary with the

Q203: Because departmental overhead costs are allocated based