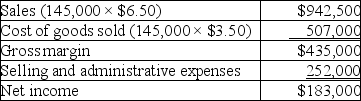

Chilly Chips, Inc., a producer of ice cream, began operations this year. During this year, the company produced 160,000 cartons of ice cream and sold 145,000. At year-end, the company reported the following income statement using absorption costing:

Production costs per carton total $3.50, which consists of $2.30 in variable production costs and $1.20 in fixed production costs (based on the 16,000 units produced). Sixty percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per carton total $3.50, which consists of $2.30 in variable production costs and $1.20 in fixed production costs (based on the 16,000 units produced). Sixty percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Definitions:

Yield

The income return on an investment, such as the interest or dividends received, expressed as an annual percentage of the investment's cost.

Market Efficiency

A concept that describes the degree to which stock prices and other securities' prices reflect all available, relevant information.

Portfolio Manager

A professional responsible for making investment decisions and carrying out investment activities on behalf of vested interests.

Interest-Rate Changes

Adjustments made by central financial authorities to the cost of borrowing money, which can influence economic activity and financial markets.

Q40: Flannigan Company manufactures and sells a single

Q66: A _ is a continuously revised budget

Q66: What are the unit contribution margin and

Q71: Under absorption costing, a company had the

Q148: A company sells a single product that

Q157: Use the following information to determine the

Q192: The absorption costing method is required for

Q195: Budget preparation is best determined in a

Q202: A company uses activity-based costing to determine

Q234: Which one of the following statements is