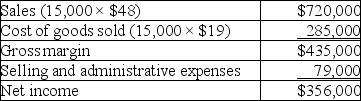

Anchovy, Inc., a producer of frozen pizzas, began operations this year. During this year, the company produced 16,000 cases of pizza and sold 15,000. At year-end, the company reported the following income statement using absorption costing:

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Definitions:

Q14: The break-even point is the sales level

Q31: Sea Company reports the following information regarding

Q34: Use the following information to prepare a

Q66: Mentor Corp. has provided the following information

Q70: Activity-based costing eliminates the need for overhead

Q83: Income under absorption costing will always be

Q95: Given the following data, total product cost

Q142: A company's flexible budget for 60,000 units

Q169: A company estimates that overhead costs for

Q195: Slosh, Inc. produces washing machines that require