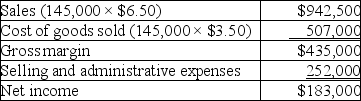

Chilly Chips, Inc., a producer of ice cream, began operations this year. During this year, the company produced 160,000 cartons of ice cream and sold 145,000. At year-end, the company reported the following income statement using absorption costing:

Production costs per carton total $3.50, which consists of $2.30 in variable production costs and $1.20 in fixed production costs (based on the 16,000 units produced). Sixty percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per carton total $3.50, which consists of $2.30 in variable production costs and $1.20 in fixed production costs (based on the 16,000 units produced). Sixty percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Definitions:

Cognitive Dissonance

The psychological discomfort experienced by an individual who holds two or more contradictory beliefs, ideas, or values at the same time.

Efficacy

The ability to produce a desired or intended result, often used in the context of therapeutic treatment's effectiveness.

Strengths-Based Approach

A method of enhancing individuals' capacities and potentials by focusing on their assets and strengths rather than weaknesses.

Coping Mechanisms

Strategies or behaviors that individuals use to manage or withstand stress, hardship, or trauma in their lives.

Q15: The most useful budget figures are developed:<br>A)

Q15: Assume that sales are predicted to be

Q30: Garcia Corporation's April sales forecast projects that

Q49: Which of the following statements is true

Q67: Compute Aztec's departmental overhead rate for the

Q93: One aid in measuring cost behavior involves

Q116: A CVP graph presents data on:<br>A) Profit

Q152: Discuss how CVP analysis can be useful

Q183: Anniston Co. planned to produce and sell

Q192: The absorption costing method is required for