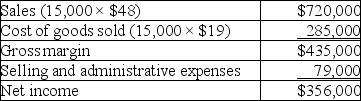

Anchovy, Inc., a producer of frozen pizzas, began operations this year. During this year, the company produced 16,000 cases of pizza and sold 15,000. At year-end, the company reported the following income statement using absorption costing:

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Definitions:

Greatest Good

A principle often associated with utilitarianism, emphasizing actions that maximize happiness or benefits for the largest number of people.

Due Process

A legal principle ensuring fair treatment through the normal judicial system, especially as a citizen's entitlement.

Denied

The refusal to grant a request or deny access to resources or rights.

Promotion

The act of elevating an employee to a higher position within the organization, often accompanied by increased responsibilities and pay.

Q12: LJ Co. produces picture frames. It takes

Q79: In a company that employs continuous budgeting

Q84: Which types of overhead allocation methods result

Q130: Milltown Company specializes in selling used cars.

Q138: ABC is more costly to implement and

Q149: ABC assumes all costs are _ because

Q151: A firm sells two products, Regular and

Q192: One of the major benefits of formal

Q198: _ is the amount remaining from sales

Q200: A company uses activity-based costing to determine