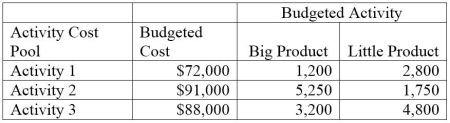

A company has two products: Big and Little. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:  Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

a. Compute the approximate overhead cost per unit of big product under activity-based costing.

b. Compute the approximate overhead cost per unit of little product under activity-based costing.

Definitions:

Overallocated

The condition when resources, such as time, money, or materials, are assigned or committed beyond the capacity or availability.

Underallocated

refers to resources or efforts that are insufficient or less than what is needed for a particular purpose or to achieve optimal efficiency.

Marginal Cost

Marginal Cost is the cost of producing one additional unit of a product or service, a crucial concept in decision-making and pricing strategies.

Monopolist

An entity that holds exclusive control over the supply of a particular good or service, allowing them to manipulate market conditions.

Q11: Minstrel Manufacturing uses a job order costing

Q44: If indirect materials costing $37,500 that were

Q64: In a process costing system, direct material

Q116: A CVP graph presents data on:<br>A) Profit

Q117: A graphic presentation of cost-volume-profit data is

Q122: Richards Corporation uses the FIFO method of

Q140: Describe the flow of labor costs in

Q146: The following information is available for a

Q153: Describe and compare the three cost estimation

Q195: Slosh, Inc. produces washing machines that require