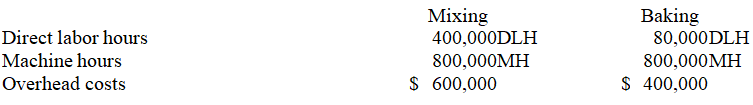

Aztec Industries produces bread which goes through two operations, mixing and baking, before it is ready to be packaged. Next year's expected costs and activities are shown below.

-Compute Aztec's departmental overhead rate for the baking department based on direct labor hours.

Definitions:

Days

A measurement of time typically used to indicate the elapsed or required time for a particular event or condition.

Tax Rate

The percentage at which an individual or entity is taxed, often applied to income or sales.

Financial Position

A snapshot of a company's assets, liabilities, and equity at a specific point in time, indicating the financial health of the business.

Statement Of Comprehensive Income

A financial statement that includes all changes in equity during a period except those resulting from investments by owners and distributions to owners.

Q16: Juarez Builders incurred $285,000 of labor costs

Q63: Why is the Process Cost Summary important

Q125: A _ is a collection of costs

Q129: Kent Manufacturing produces a product that sells

Q132: Pitt Enterprises manufactures jeans. All materials are

Q148: Wind Fall, a manufacturer of leaf blowers,

Q180: ABC can be used to assign costs

Q194: A company's overhead rate is 200% of

Q227: During its most recent fiscal year, Dover,

Q241: A manufacturer reports the following information below