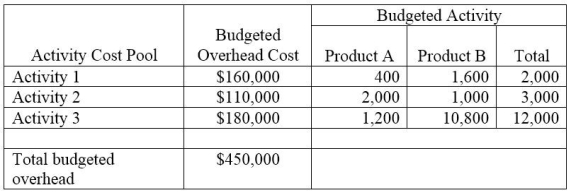

A company has two products: A and B. It uses a plantwide overhead allocation method based on activity 2 and has prepared the following analysis showing budgeted costs and activities. Use this information to compute (a) the company's plantwide overhead rate and (b) the amount of overhead allocated to Product A.

Definitions:

Sold Units

The total number of units of a product that have been sold within a specific time period.

Variable Expenses

Expenses that vary directly with changes in business activity level, such as sales volume or production quantity.

Fixed Expenses

Expenses that remain constant regardless of any variations in the volume of production or sales.

Break-Even Point

The level of sales at which profit is zero.

Q18: Adams Manufacturing allocates overhead to production on

Q28: The departmental overhead rate method allows each

Q99: Allocated overhead _ vary depending upon the

Q131: The predetermined overhead rate based on direct

Q169: Barclay Enterprises manufactures and sells three distinct

Q198: Andrews Corporation uses the weighted-average method of

Q206: Richards Corporation uses the weighted-average method of

Q208: Over recent decades, overhead costs have steadily

Q211: A job cost sheet is useful for

Q243: A statistical method for identifying cost behavior